The United States housing market has been on a rollercoaster ride lately, leaving mortgage lenders to navigate uncharted waters. With interest rates soaring in 2022, demand from prospective home buyers has been cooling o...

Mortgage document management is a critical component of the mortgage industry, involving the processing and storing of various documents such as loan applications, credit reports, and title deeds. The efficiency and acc...

Markets slow and grow. It is only natural to strategize according to the existing state of the market. But if you had a chance to use the slow markets to your advantage and sharpen your axe, would you not grab it? Of...

The key driver in purchase decisions is no longer the lowest price, but the best experience and consistent, positive engagement, especially in the mortgage industry to understand how you can drive your customers to choos...

Don’t Let Automation Overwhelm You Not too long ago, a few weeks back, the Sales team at RAP was thrilled beyond words. A team member had connected with a prospect who was eager and ready to implement our hyperautomat...

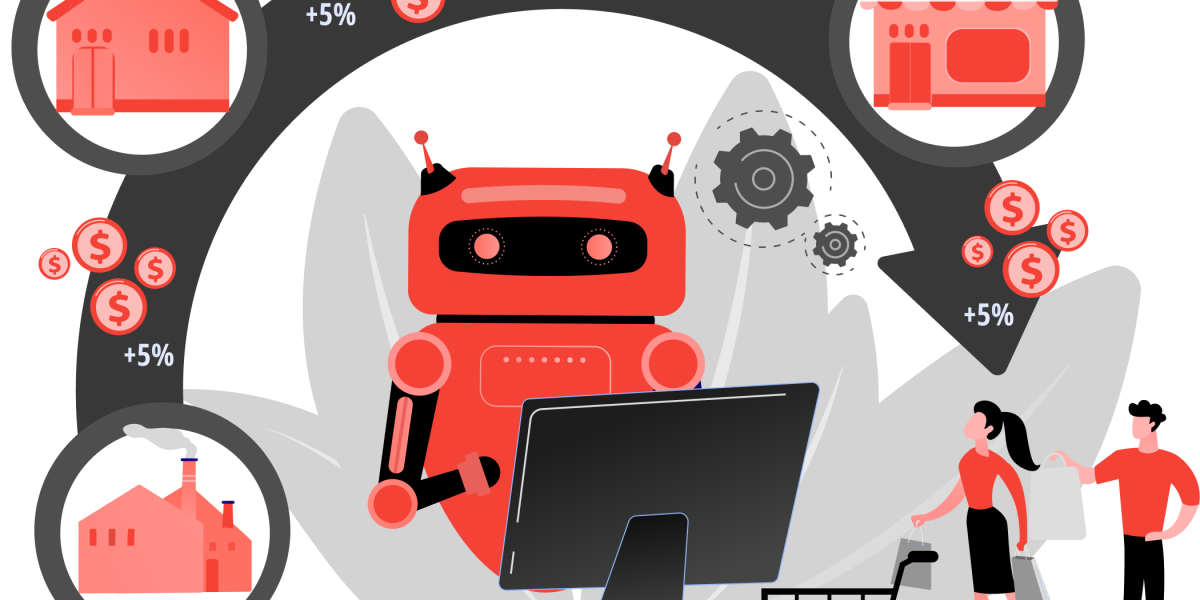

In an increasingly saturated corporate world that is reeling from the aftermath of a global pandemic, modern business owners are under tremendous pressure to optimize costs and boost productivity. On top of that, the cus...

“Fear is an idea-crippling, experience crushing, success stalling inhibitor, inflicted only by yourself. – Stephanie Melish, Motivational Speaker Can’t argue much there with Stephanie, isn’t it? After all, fe...

On average, mortgage loan processing takes around 30 to 45 days for completion. This is mainly because the process is replete with labor-intensive and time-consuming tasks such as data collection, data extraction, and da...

The digital revolution has impacted many industries, including the mortgage industry. For starters, customer expectations have drastically altered. Today, they automatically expect their lenders to offer seamless ex...

Hyperautomation is the real deal. It is considered (and rightly so!) to be the next driver of the digital revolution. The aim of hyperautomation is simple – to integrate all automated activities under one umbrella or a p...