Chargeback disputes can be a frustrating and costly issue for any hospitality enterprises. When a guest files a chargeback, it not only affects the bottom line but also tarnishes the merchant’s reputation. One of the critical aspects of successfully fighting a chargeback dispute is providing compelling evidence to support your case. Lets delve into the importance of evidence in effective chargeback management, the meticulous approach HMCs need to adopt to file chargebacks and recover lost revenue, and the key elements that constitute persuasive evidence to fight customer disputes effectively.

The Importance of Compelling Evidence for all Disputes:

When a chargeback occurs, your business gets only one opportunity to submit evidence to fight and win a chargeback dispute. This means that you must be meticulous in preparing and presenting your evidence. Compelling evidence plays a vital role in persuading the card issuer or issuing bank to win a chargeback dispute. It helps establish the legitimacy of the charge, proves that the guest received the promised goods or services, and demonstrates that you followed proper protocols.

While automation streamlines the chargeback process, its impact goes beyond operations. Discover how AI-driven automation is also rehumanizing work itself — explore the insights here.

Key Evidence to Win a Chargeback Dispute:

To build a strong case against every chargebacks, include the following key elements in your evidence:

Proof of transaction: Provide the original receipt or invoice that clearly shows the guest’s authorization and agreement to the charges. This could include a signed credit card slip, a digital acceptance of terms and conditions, or an email confirmation.

Delivery or service confirmation: Demonstrate that you delivered the promised goods or services as agreed upon. This could include proof of shipment or delivery, records of on-site services, or guest signatures acknowledging satisfaction.

Communication records: Include any correspondence or communication with the guest that supports your position. This may include emails, text messages, or even recorded phone conversations.

Refund or cancellation policies: Clearly outline your refund and cancellation policies and provide evidence that the guest was aware of these policies at the time of the transaction.

Security measures: If the chargeback reason is related to fraud, highlight the security measures you have in place to protect guest information. This could include encryption methods, security certifications, or authentication protocols.

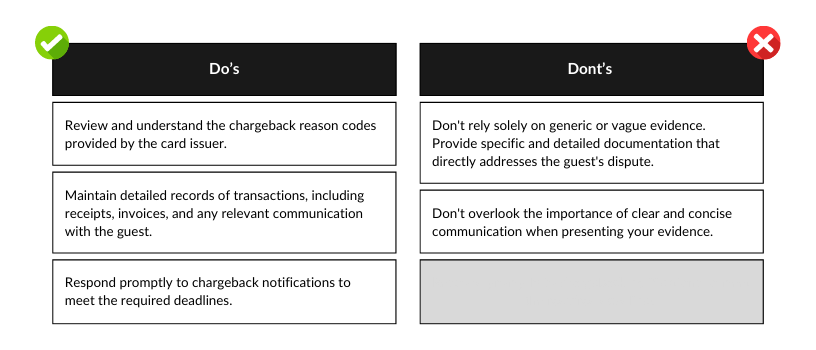

To increase their chances of successfully winning chargebacks, HMCs need to adopt a meticulous chargeback management strategy when gathering and submitting evidence. Here are some Do’s and Don’ts to win more chargebacks:

3 Key Steps for Effective Dispute Responses:

- Keep it Relevant and Professional

When responding to a dispute, avoid lengthy introductions or complaints about the customer. Stick to the original purchase facts in a neutral and professional tone. Including email or text exchanges can be helpful but remember to only include relevant information. Be factual, professional, and concise to make your response compelling without overwhelming the cardholder’s issuing bank.

- Clear and Accurate Evidence is Key

Card issuers do not follow links, so make sure to include clear screenshots of your terms or policies as they appear during checkout or on your site. This is crucial to strengthen your argument to dispute the customer’s claim.

- Highlight Your Terms of Service and Refund Policy

In disputes, the fine print matters. Show proof that your customer agreed to and understood your terms of service during checkout, or that they did not comply with your return or refund policies. Including a clean screenshot of how these policies are presented during checkout is essential – a text copy won’t suffice.

Of course, identifying the right metrics is half the battle. Businesses that have implemented intelligent process automation (IPA) can gain an edge by measuring the real impact of their automation initiatives- a key factor when compiling credible, data-backed responses to disputes.

If the evidence submitted to fight a chargeback is not clear and concise, it can have several negative implications for your case. Here are some potential consequences:

1. Inadequate defense: Unclear or insufficient evidence may fail to effectively counter the guest’s dispute. When the evidence lacks clarity, it becomes challenging for the card issuer or bank to understand and evaluate your position. As a result, they may be more inclined to rule in favor of the guest, leading to a lost chargeback case.

2. Lengthy resolution process: When evidence is unclear or lacks necessary details, it can prolong the resolution process. The card issuer or bank may request additional information or clarification, causing delays and increasing the administrative burden on your business. This can result in additional time and resources spent on resolving the chargeback, potentially impacting your daily operations.

3. Damaged reputation: A failure to present clear and concise evidence may reflect poorly on your business’s professionalism and credibility. Card issuers and banks may view incomplete or unclear evidence as a sign of negligence or an attempt to hide relevant information. This could harm your reputation within the industry and among potential guests.

4. Loss of revenue: Ultimately, the goal of fighting a chargeback is to protect your revenue and recover funds for the services rendered. If your evidence is unclear and fails to convince the card issuer or bank of the legitimacy of the charge, you may lose the dispute. This results in a financial loss, as you would not only have to refund the disputed amount but also incur chargeback fees.

Fighting chargebacks requires a strategic approach, with compelling evidence playing a pivotal role in defending your hospitality business. By understanding the chargeback process, being meticulous in gathering evidence, and including key elements in your submission, you can increase your chances of successfully refuting unjustified disputes and win chargebacks with fewer costs.

Remember, providing compelling evidence not only protects your revenue but also reinforces your reputation as a trustworthy and reliable service provider.