Meet Emily, the passionate CTO of a global hotel chain. She’s spent weeks excitedly researching and testing AI-driven chatbots, convinced they are the future of customer service in the hospitality sector. The thought of revolutionizing customer engagement fills her with anticipation.

Across the hall sits George, the CFO known for his prudent financial acumen. While he admires Emily’s zeal, he feels a growing unease. Every time he walks past the overstretched accounting department, he sees harried faces struggling with mountains of supplier invoices. The accounting bottlenecks impact vendor relationships and financial forecasting accuracy, causing him sleepless nights.

Amid a clatter of coffee cups, George shares his concerns about the strained accounting department. Emily, taken aback, hadn’t realized the extent of this problem.

The gravity of the situation dawns on her, and with it comes an epiphany. She realizes the transformative potential of Robotic Process Automation (RPA) for invoice processing. Redirecting part of the chatbot funds to automate accounting processes becomes an exciting new project.

Implementing RPA revolutionizes the accounting department, eliminating bottlenecks and relieving the hardworking staff. This collaboration turns Emily and George’s worries into relief and accomplishment, showcasing the power of technology where it’s most needed.

This hypothetical situation underscores the power of empathetic communication and collaboration in making strategic decisions that positively impact the business and its people.

In the business world, the bridge connecting the CTO (Chief Technology Officer) and CFO (Chief Financial Officer) has often been perceived as a shaky one. Traditionally, these roles have held contrasting views on how best to support the company’s growth. One has its eye on the tech horizon, searching for innovative solutions to drive efficiencies and unlock new value, while the other is the financial guardian, ensuring economic sustainability and demanding high returns on investment. It’s like comparing apples and oranges – or so it seems.

However, in our increasingly digitized, competitive business landscape, it is becoming more apparent that these roles should not be seen as opposites but instead as valuable collaborators. Yes, you read it right – the CTO and CFO can, and should be, best friends. Why? Let’s delve into it.

The CTO’s Challenge

As the CTO, your role often entails being the driving force behind digital transformation and technical innovations. This role can be particularly challenging when the initiatives you’re keen to implement come with a hefty price tag. Understanding the full spectrum of tech advantages, you know that investing in new initiatives, especially automation, will reap significant benefits in the long run.

However, getting buy-in from the rest of the executive team, particularly the CFO, is not always easy. The reasons are plausible. New tech initiatives often require a substantial upfront investment, and the return on investment (ROI) is not immediately apparent. Also, there’s the risk of failure, as technology and market trends can be unpredictable.

This is where the CFO comes into the picture.

The Power of Collaboration

Collaboration with the CFO from the get-go can help bridge the understanding gap that often exists between the technical and financial dimensions of a company. A CFO’s primary responsibility is to manage and optimize the company’s financial resources. They are concerned not only with the cost of new initiatives but also with the assurance that these investments will deliver tangible, sustainable financial value.

Therefore, if the CTO can effectively communicate the long-term benefits of these investments, the CFO can become a formidable ally. Not only can they help secure the necessary funding, but they can also support you in demonstrating the financial value of these initiatives to other stakeholders.

Take automation initiatives, for example. It’s no secret that automation can drastically improve efficiency, reduce human error, and free up employees for more value-added tasks. However, it also requires a considerable initial investment and a transition period during which the benefits still need to be realized.

Having a CFO understand and advocate for long-term cost savings and efficiency improvements can be a game-changer. This may involve the CTO presenting data-driven scenarios showcasing potential benefits, like increased productivity, cost savings, risk reduction, or revenue generation, and the CFO providing financial modeling and forecasting to quantify these benefits.

Building the Bond

So how do we build this all-important CTO-CFO friendship?

1. Open Communication: The foundation of any good friendship is communication. Regularly engage with your CFO, share your plans, and explain the potential of various tech initiatives in a language they understand – numbers.

2. Inclusive Planning: Involve the CFO early in the planning process. Let them understand the technology roadmap and how it aligns with the company’s strategic objectives. This way, the CFO becomes an invested partner rather than just a gatekeeper.

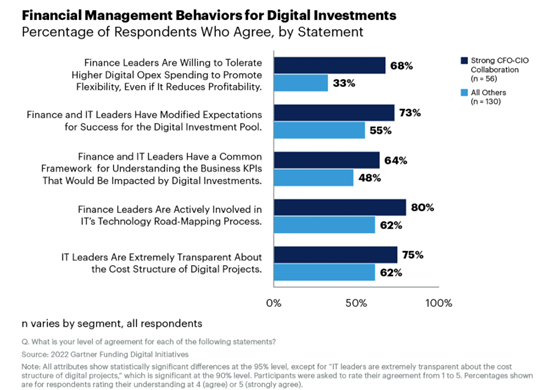

3. Shared KPIs: Establish shared performance indicators that reflect your tech initiatives’ value to the business. You create a common ground that fosters cooperation by tying technological advancement to financial success.

4. Continual Education: Help the CFO understand the evolving tech landscape. Offer insights into how technology is not just a cost center but an enabler of business performance and strategic advantage.

Ultimately, CTOs and CFOs have one shared goal: driving the company’s success. By working together, they can make a powerful duo that ensures the organization is financially robust and technologically advanced. A strong CTO-CFO partnership can balance the risk and rewards of tech investments, championing initiatives that deliver real value and help the company thrive in the digital age.

It’s time to extend that hand of friendship across the business bridge. You never know; the CTO and CFO could become the company’s next dynamic duo.