Accounts payable is a vital process in hospitality accounting that directly impacts a business’s day-to-day operations and success. With proper execution, vendors may be paid on time, and the business could come to a grinding halt. Unfortunately, traditional manual accounts payable processes can be a nightmare due to multiple vendors, varying timelines, different formats of documents, etc.

Imagine a day where invoices get lost, data entry errors abound, and processing times take forever, leading to frustrated vendors and missed opportunities for cost savings. Such a reality would undoubtedly keep any hospitality business owner up at night.

IPA is one of the solutions that can help streamline accounts payable processes, and adopting it can be a game-changing strategy in the hospitality industry. This blog will show you how IPA solutions can simplify the AP process, and the benefits of using these solutions. We’ll also guide you with best practices for implementing IPA, positioning you for success in the hyper-competitive hospitality industry.

IPA can address issues such as high processing costs, data entry errors, long processing times, and limited visibility into cash flow. Even with the industry’s high volume of invoices and various vendor payment terms, IPA can help accounting teams easily navigate these challenges.

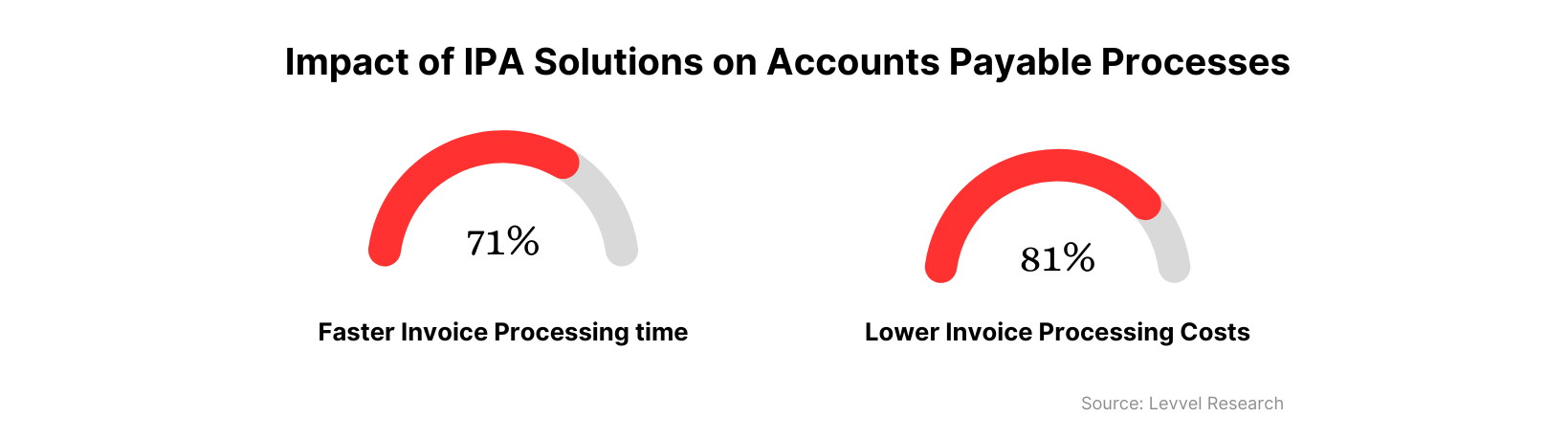

Levvel Research, a research and advisory firm, conducted a survey that found that businesses that implemented IPA solutions for their accounts payable processes experienced an average of 71% faster invoice processing times and 81% lower invoice processing costs than businesses that relied on manual processes.

With the combined powers of AI and machine learning, IPA solutions streamline the accounts payable processes by automating tasks such as invoice processing, payment approvals, and vendor management. The result is a faster, more efficient, and more accurate accounts payable process. It allows hospitality businesses to manage their finances better, maintain positive vendor relationships, and focus on providing exceptional guest experiences.

The Power of IPA Solutions for Accounts Payable in the Hospitality Industry

Without timely and accurate payment processing, hospitality enterprises risk damaging their relationships with vendors, incurring late payment fees, and disrupting their cash flow.

One key area where IPA can be particularly useful is invoice processing. Using machine learning algorithms to read and categorize invoices, IPA solutions can quickly process invoices and flag any discrepancies or errors for human review. This can reduce processing times from days or weeks to hours, ensuring vendors are paid on time and without errors.

IPA can also automate payment approvals, routing invoices to the appropriate approvers, and provide real-time visibility into the approval process. This can reduce processing times and help businesses avoid late fees or missed payments.

IPA can be used to manage vendor relationships more effectively. By automating vendor management tasks such as onboarding, contract management, and compliance checks, hospitality enterprises can better manage vendor relationships and negotiate more favorable payment terms.

Whether you’re in hospitality or managing an accounting KPO, innovative automation strategies are transforming how finance teams operate. Read how accounting KPOs are thriving amidst chaos with bulletproof strategies.

Value of Simplifying the Account Payables Process with IPA

Using IPA for accounts payable in the hospitality industry can offer numerous benefits to businesses. One of the most significant advantages is increased efficiency and accuracy.

In addition, IPA solutions give businesses real-time visibility into their accounts payable processes, which is essential for managing cash flow effectively.

Enterprises can leverage this visibility to identify areas to optimize their operations and negotiate more favorable payment terms with vendors. This helps businesses make informed financial decisions and improve their financial health.

Another key benefit of using IPA solutions is that they help businesses comply with industry regulations and internal policies. By automating compliance checks and other regulatory requirements, hospitality businesses can minimize the risk of fines, legal action, and reputational damage.

This ensures that the accounts payable process is conducted securely and competently, which is essential for maintaining the trust and confidence of stakeholders.

IPA Solutions for Accounts Payable in the Hospitality Industry

There are several IPA solutions available for accounts payable in the hospitality industry. These solutions range from standalone software platforms to integrated systems that can be customized to meet the specific needs of hospitality businesses.

Solutions developed using RAPFlow use AI and machine learning algorithms to automate invoice processing, payment approvals, and vendor management, providing a fast and efficient accounts payable process for hospitality businesses. RAPFlow uses process automation to manage workflows and approvals, reducing processing times and ensuring invoices are paid on time and without errors.

Best Practices for Implementing IPA for Accounts Payable in the Hospitality Industry

Successfully implementing IPA for accounts payable in the hospitality industry requires careful planning and execution. Some best practices for implementing IPA in the hospitality industry include:

- Ensuring data quality and security: IPA solutions rely on accurate and secure data to function effectively. It’s essential to ensure that data is clean, accurate, and protected from unauthorized access.

- Providing employee training: IPA solutions can be complex and require practical training. Providing employee training and support can help ensure that employees are comfortable using the system and can maximize its benefits.

- Managing change effectively: Implementing IPA solutions can significantly change an organization. Effective change management ensures successful implementation, and employees support the new system.

In conclusion, the hospitality industry can significantly benefit from implementing IPA solutions in its accounts payable processes. With the help of automation, businesses can streamline their invoice processing and reduce the risk of fraud and errors. Not only does this increase efficiency and accuracy, but it also saves time and resources for the company.

Schedule a demo today and discover how we can help streamline your Account Payable process.