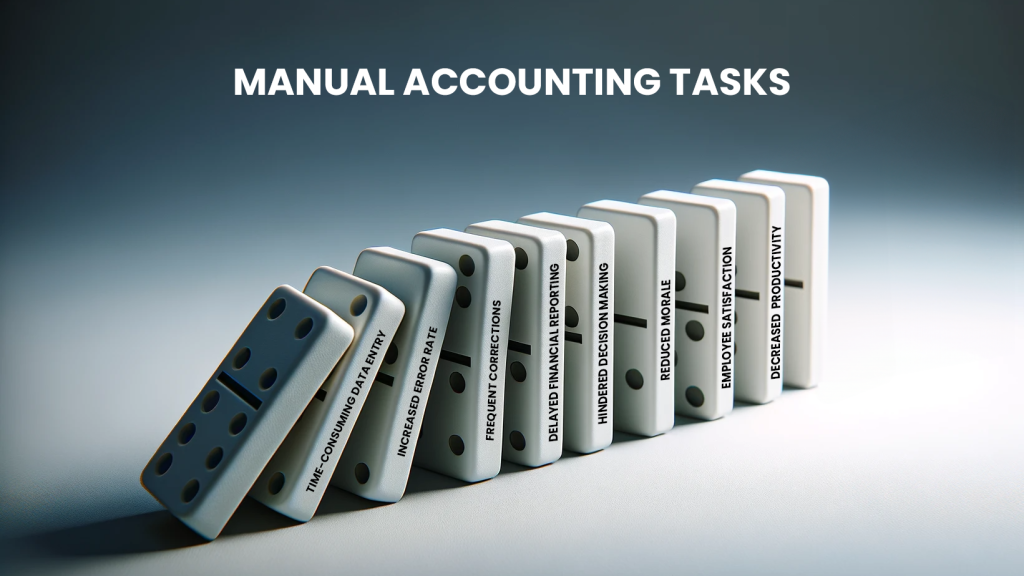

For most professionals, accounting work evokes anything but enthusiasm. The tedious grind of manual data entry, the monotony of number crunching, the looming threat of errors – it’s often seen as necessary drudgery. But what many don’t realize is that relying on antiquated manual processes has a domino effect on productivity and morale.

The First Domino: Time-Consuming Data Entry

In the realm of accounting, the manual entry of data is not just a mundane task; it’s a significant drain on time and resources. A substantial portion of the workforce spends an inordinate amount of their workweek on repetitive data entry tasks.

According to a report by Smartsheet, over 40% of workers dedicate at least a quarter of their workweek to manual, repetitive tasks, including data entry. This translates to approximately 10 hours in a standard 40-hour workweek, representing a massive diversion of resources from more strategic and analytical tasks.

The Second Domino: Increased Error Rate

Manual data entry is inherently prone to errors. While seemingly small, these errors can accumulate and significantly affect financial reporting and decision-making.

The average error rate in manual data entry hovers around 1%. This might appear minimal at first glance but considering the volume of data handled by accounting departments, these errors can lead to major inaccuracies in financial reports.

The Ripple Effect: Inaccurate data can disrupt invoice processing and accounts payable, leading to delayed payments, over or underpayment of bills, duplicate bills, or accounting errors. This not only affects the integrity of financial reporting but also can lead to financial losses and compliance issues.

The Third Domino: Frequent Corrections and Reconciliations

The inevitable outcome of manual data entry errors is a cycle of continuous corrections and reconciliations. This repetitive process is not only time-consuming but also costly, diverting resources away from more productive activities.

Burden of Corrections

Correcting errors in financial data is far more complex and time-consuming than entering it correctly in the first place. The 1-10-100 rule, a concept in quality management, illustrates this well: For example, at the point of entry, if it costs $1 to verify data, it costs $10 to clean it up later, and $100 or more if the error is not caught until after financial reports are made.

Impact on Workflow

These ongoing corrections create bottlenecks in the workflow. Employees find themselves constantly revisiting and revising previous work, which not only slows down overall productivity but also affects their focus on current and future tasks.

The Fourth Domino: Delayed Financial Reporting

In accounting, delays in financial reporting, often caused by manual data handling and error corrections, are more than mere inconveniences. They hinder the provision of real-time financial insights crucial for strategic business decisions. Accurate and timely reports are vital for maintaining the integrity of balance sheets and guiding investment strategies.

Furthermore, in the compliance-driven world of audits, these delays can amplify risks of inaccuracies and potential non-compliance, putting financial credibility at stake. For accountants, streamlined reporting is not just a matter of efficiency; it’s a cornerstone of robust financial management and strategic business planning.

Example of Efficiency Loss– Slow turnaround times in data extraction and entry are a significant contributor to delays in financial reporting. Even most of the skilled typists can only type 60-90 words per minute, which pales in comparison to the speed and efficiency of automated systems.

The Fifth Domino: Hindered Decision Making

Decisions based on delayed or flawed data can lead to misaligned strategies, affecting everything from resource distribution to market tactics.

Financial Faux Pas: Decisions anchored in outdated or erroneous financial data can steer a company off course, affecting critical areas such as resource allocation and market positioning. These miscalculations can lead to tangible financial setbacks and lost opportunities.

The High Price of Inaccurate Data: Misinformed management decisions, stemming from flawed financial data, can cause a significant disconnect with the company’s true financial health, potentially jeopardizing long-term growth and stability. In the accounting world, precision is not just a best practice; it’s a necessity for informed, strategic decision-making.

The Sixth Domino: Reduced Morale and Employee Satisfaction

The tedium of repetitive tasks can lead to decreased morale, potentially increasing turnover rates in skilled accounting roles. Is it any wonder that many accounting professionals report anxiety and burnout? Their days become consumed with reacting to crises rather than proactively driving strategy.

The Monotony of Manual Tasks

Repetitive, error-prone tasks lead to job dissatisfaction. Employees engaged in such tasks often feel their skills are underutilized, affecting their overall morale and engagement with their work.

Impact on Employee Turnover

Continual engagement in monotonous, low-value tasks can lead to higher employee turnover rates. The frustration and lack of fulfillment from such tasks can drive skilled employees to seek more rewarding opportunities elsewhere.

The Seventh Domino: Decreased Overall Productivity

This culmination of inefficiencies leads to a noticeable slowdown in overall operations, from financial processing to strategic initiatives.

Operational Drag

The slow churn of manual data entry extends its shadow beyond financial reporting, dampening various operational areas. This drag manifests in slower financial cycles, delayed insights for strategic action, and diminished employee morale in accounting teams, culminating in stunted operational efficiency and growth.

Delayed Financial Close

The time-intensive nature of manual entries leads to prolonged monthly and yearly closes, delaying critical financial insights.

For instance, a notable SEC press release sheds light on a significant concern in accounting: the ramifications of delayed financial reporting. In this instance, the SEC imposed fines of $250,000 on eight companies. These penalties were levied for not adequately disclosing that their reporting delays were due to expected financial restatements or corrections.

This example highlights the critical importance of ensuring timely financial closes in accounting, demonstrating how delays can lead to regulatory consequences and emphasizing the need for prompt and accurate financial processes within accounting departments.

Resource Misallocation: Valuable resources, including skilled accountants, spend disproportionate time on routine data entry tasks instead of strategic financial analysis or advisory roles, leading to underutilization of expertise.

Blocked Strategic Pathways: Precious time and resources, entangled in the web of manual inefficiencies, bar accounting departments from embracing innovation and exploring new financial strategies. This not only stifles the department’s evolution but also hampers the company’s competitive edge in the market.

This inefficiency isn’t limited to finance. Other sectors like hospitality are facing similar challenges with fragmented systems. Digital transformation in hospitality is proving how automation can streamline operations, improve customer experience, and cut down on repetitive administrative tasks.

But there is an alternative to this vicious cycle: AI-enabled automation. The risk of manual inefficiencies is vastly diminished by implementing AI-enabled accounting automation. Systems seamlessly handle routine tasks, freeing up staff for higher-level analysis. Decisions can happen rapidly with trustworthy data.

Rather than a source of dread, accounting can become an efficient driver of productivity and insight. Imagine being able to focus on big-picture goals instead of fixing errors. Picture your team relieved of monotonous grunt work, empowered to think strategically. This is the promise of AI-enabled automation. Read more about how automation can keep you ahead of the curve in accounting.

The choice is clear – continue down the manual path of drudgery or embrace more intelligent, automated processes. One traps professionals in a cascade of inefficiency, frustration, and stress. The other elevates accounting into a source of timely, accurate insights that move companies forward. The domino effect can be stopped, but only by taking the first step away from antiquated systems. The future of productivity and profitability may very well depend on it.

Ready to make the switch to smarter accounting? Contact us today to explore AI-enabled automation tailored to your business needs. Transform your accounting into a strategic asset. Let’s innovate together!

I’m truly enjoying the design and layout of your site.

It’s a very easy on the eyes which makes it much more enjoyable for

me to come here and visit more often. Did you hire out a developer to create your theme?

Outstanding work!